Hsa Approved Expenses 2025. View contribution limits for 2025 and historical limits back to 2004. There are a few ways to pay for expenses directly with your hsa funds:

How to SetUp & Get the Most from a Health Savings Account (HSA), You submit a claim for health and dental expenses to hsa for reimbursement. The hsa contribution limit for family coverage is.

New HSA/HDHP Limits for 2025 Miller Johnson, Expenses incurred by the birth mother associated with an adopted baby's birth are not qualified medical expenses for the hsa account holder (and spouse). Get the irs's rules for your hsa, including those about expenses, eligibility, contributions, reimbursements, dependents, ownership and more.

HSA Eligible Expense List, For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. The health savings account (hsa) contribution limits increased from 2025 to 2025.

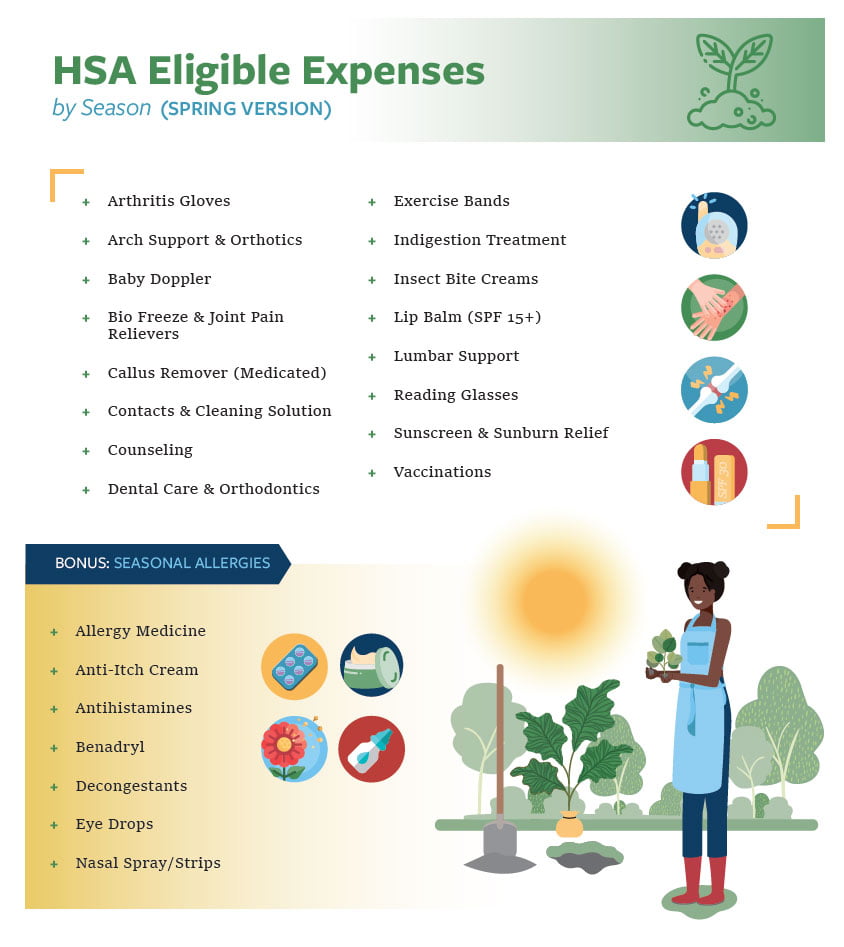

Springtime HSA Eligible Expenses Employee Benefits Management Group Raleigh NC, Please visit the irs website and review the eligible expense list on your member portal for more information. For 2025 plan years, the.

Significant HSA Contribution Limit Increase for 2025, For 2025 plan years, the. Please visit the irs website and review the eligible expense list on your member portal for more information.

Hsa 2025 Family Limit Ciel Melina, For 2025 plan years, the. What expenses are eligible for hsa?

Eligible Expenses for FSAs, HSAs, and HRAs, The amount you can contribute is determined by whether you have individual or family coverage. What is the maximum hsa contribution for 2025?

What is an HSA Qualified Expense HSA for America, Everything you need to know. The hsa contribution limit for family coverage is.

Approved Fsa Expenses 2025 Trula, Hsa (health savings account) eligible expenses are those medical expenses covered by hsa funds. For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

IRS HSA Eligible Expenses, The health savings account (hsa) contribution limits increased from 2025 to 2025. For 2025 plan years, the.

In 2025, you can contribute up to $3,850 to an hsa with an individual health insurance plan, or $7,750 with a family plan.